Depression Proof

How to prepare for the coming decade of economic depression by profiting from the mother of all crashes in 2024-2026.

Dr. Fred Foldvary is a geolibertarian economist who in 1997 famously predicted the next recession would occur in 2008 specifically. Watch Foldvary’s prediction, below, and ask yourself: how is it possible to predict a recession 11 years before it happens?

Foldvary’s legacy is his synthesis of the Georgist and Austrian schools of economics. Foldvary explains the synthesis in two of his major works: The Depression of 20081 and The Business Cycle: A Georgist-Austrian Synthesis.2 (Copies of Foldvary’s works with my notes are archived here and here.)

This article proceeds in three parts. The first part summarizes Foldvary’s geo-Austrian theory of the business cycle. The second part analyzes the current macroeconomic climate through the perspective of geo-Austrian theory. The third part derives strategies to mitigate the impact of depression on personal finances. Lastly, the article concludes by outlining my planning to prepare for the mother of all recessions. “Never let a good crisis go to waste.”

The Geo-Austrian Analysis

Introduction

An economic “recession” is a fall in total output over the course of at least six months. Output is measured by the Gross Domestic Product (“GDP”) of an economy. An economic “depression” occurs when GDP per capita falls below the long-run trend.

The business cycle has six phases: economic expansion; the peak; recession; depression; the trough (or bottom); and recovery.

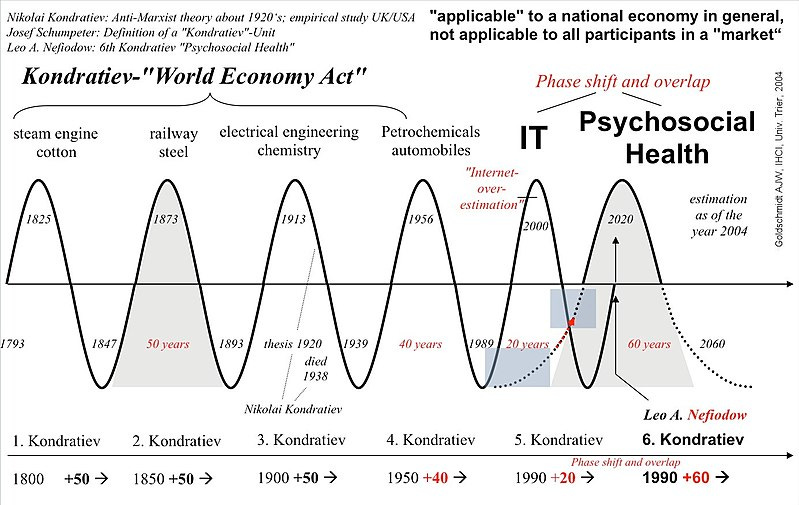

Various economic cycles overlap in contributing to the overall business cycle. In the United States, these cycles include minor inventory cycles every few years; politically-related economic cycles every four years; major cycles of retooling manufacturing equipment every decade or so; the real estate cycle every 18 years or so; and the Kondratieff supercycle of technological advances every 50-60 years.

Economic cycles can be visualized as sine waves. Overlapping sine waves cause constructive or destructive interference. The same is true of economic cycles. As a result, the overall business cycle can have bigger or smaller booms and busts. The amplitude of each wave in the overall cycle will be larger when the momentum of economic cycles are aligned and smaller when they are opposed.

A geo-Austrian analysis focuses on the 18-year real estate cycle. It does not address all aspects of the overall business cycle. However, the real estate cycle is by far the most important. This is especially true for homeowners who have the vast majority of their net worth tied up in real estate.

It is worth noting the current real estate cycle is due to peak around 2024 in a Presidential election year when political risks are elevated. The peak of this real estate cycle also aligns with the peak in the Kondratieff supercycle. 2024 will see downward momentum aligning in at least three important economic cycles.

According to a geo-Austrian analysis, two related factors combine to drive the real estate cycle. One factor is financial. The other factor is “real,” meaning non-financial with an emphasis on the real estate market.

The financial factor is attributable to central banks expanding the supply of money and credit in an economy. Monetary expansion reduces interest rates, which induces more investment, especially in real estate.

The real factor is the result of increased investment in real estate. Increased investment can take the form of economic investment in construction or financial investment speculating there will be further increases in real estate values.

The banking system ties the real and financial factors together. Land values are at their highest at the peak of the business cycle. At the same time, central banks raise interest rates to combat inflation, including the higher cost of living due to inflated real estate values.

Higher interest rates make borrowing more costly. Higher costs cause a decrease in construction and demand for real estate. Less construction and lower real estate prices cause growth in the economy to slow. The result is a further reduction in investment and aggregate demand. Consequently, the economy falls into recession and eventually depression.

The historical record shows the real estate cycle has an average duration of 18 years. Fred Harrison breaks down the phases of the cycle in his book Boom Bust: House Prices, Banking, and The Depression of 2010. On average, the crash from peak to trough occurs in two years; the recovery from depression takes two years; and the expansive phase of the cycle where developers buy land construct new housing lasts 14 years.

Why should I care about the Geo-Austrian model?

A sophisticated investor has two aims. The first is to be “risk-on” during the 14-year expansive phase of the cycle by investing their financial capital. The second is to be “risk-off” just before the crash. Sophisticated, active investors will play both sides of the market—long and short—to make money when prices rise and fall.

There is a general consensus among long-term investors it is not possible to “time the market,” by which they mean predict peaks and troughs. That consensus is false. Indeed, correctly anticipating changes in the phases of the business cycle is by far the most important thing any investor can do to build wealth.

Consider, for example, a long-term investor who purchased the S&P 500 (a weighted index of the largest 500 companies in the U.S.) on March 27, 2000, just ahead of the 2001 financial crisis. The investor would have to wait until June 16, 2007, more than seven years later, just to breakeven on their investment in nominal terms.

The investor would then see a positive nominal return in just one week over the three months before the start of the Great Recession. They would have to hold onto their losing investment until March 18, 2013, to reach breakeven again.

However, nominal prices do not account for the 38 percent decline in the value of the dollar due to inflation from 2000 to 2013. The investor would therefore have to wait until the week of December 15, 2014, to breakeven in real terms.

In short, the investor would have spent 14 and a half years invested in the market without earning a penny of real return. All the while they would have had to stomach paper losses of 50 and 57 percent through the course of two recessions.

In comparison, a sophisticated investor who sold at the top of the tech bubble in 2001; bought the bottom of the recession in late 2002; sold at the top of the housing bubble in late 2007; and bought the market again in early 2009 would have made a real profit of more than 300 percent by the time our first investor finally saw a positive real return.

Actively shorting both recessions would have increased real returns even more. It is not unreasonable to think a sophisticated, active investor, who used leveraged instruments like equity options, could have returned 1,000 percent real profit while the passive, unsophisticated, long-term investor was busy treading water.

The reason financial advisors do not recommend trying to time the market is because they do not understand geo-Austrian theory and, therefore, do not have the competence to time the market themselves. It is much easier for advisors to manage unsophisticated investors’ expectations than it is to manage investments properly.

Most financial advisors simply blame the market when they lose their clients’ money in a recession. Many advise their clients to hold the course through downturns. Afterall, the risk of 15 years without any real return is on you; the advisor will continue to claim a fee so long as your assets are under their management.

“Take your money out of the market and out of our fund now to avoid losses and fees. I’ll call you in a year, maybe two, maybe eight, to try to win your business back when the time to invest is right,” said no financial advisor ever.

Timing the market is easier said than done, however. Nonetheless the stark difference between no profits over almost 15 years and profits of more than 300 percent in the same timeframe should motivate even the laziest among us to become sophisticated investors capable of actively managing our own affairs.

Geo-Austrian theory is a powerful tool to that end. The tell-tale signs of a looming recession are readily observable if you know where to look.

The Business Cycle

A recession can be brought about sooner or later depending on the fiscal and monetary policy of the government. However, the legislative branch of government is almost always reactive rather than proactive. Most governments follow the Keynesian approach of responding to recession by increasing public spending, rather than adopting loose fiscal policy deep into the expansive phase of the cycle.

The Federal Reserve is therefore the only institution that routinely influences the timing of a recession. The Fed uses monetary policy, meaning the expansion or reduction of the money supply, to influence the latter stages of the cycle. The Fed expands the money supply with lower interest rates to promote growth and employment. The Fed reduces the money supply with higher interest rates to combat inflation. Foldvary explains:

At the peak of the business cycle, the Fed faces a dilemma. The large past increase in the money supply now increases price inflation. But economic growth is slowing, and a reduction in the growth of the money supply to stop the inflation would raise interest rates and push the economy into a recession. The Fed must choose between greater inflation and a recession.3

The Fed cannot address both recession and inflation simultaneously because addressing one issue requires exacerbating the other. Nor can the Fed stop recession from occurring altogether. Varying monetary policy will simply alter the timing at which the peak of the business cycle occurs. The real factor of the cycle drives booms and busts the Fed is ultimately powerless to prevent.

It’s All About the Benjamins Mostly About Land Values

Land is broadly defined in economics to mean all natural resources and forces. It is the primary factor of production in all economies because no one can produce anything without using land. Labor does not need any capital to produce wealth. And the he owner of capital can earn interest without laboring. But neither labor nor capital can produce anything without access to land.

Real estate includes improvements like buildings as well as the land. Buildings, however, are depreciating assets since they degrade with the passage of time. When the price of real estate increases, the increase is mostly due to appreciation in land value, not in the value of the buildings on the land. When we talk about the real estate cycle we are really talking about changes in the value of land.

Land values determine the growth rate in economies where economic rents from land are privately owned. As land values increase, the costs of production increase, choking off investment. But what causes the rate of growth in an economy to change from positive to negative? To answer that question we need to distinguish economic investment from financial investments.

Financial investments are stocks, bonds, real estate, etc. Economic investment concerns the stock of capital goods, like machines, buildings, and goods held in inventory. Economic investments drive the business cycle not financial investments.

Economic investment falls when business owners and investors expect lower profits in the short-term. Expectations of lower profits are caused by higher costs and lower aggregate demand. We can deduce recessions are caused by higher costs rather than lower demand because demand falls in response to a recession not in advance of it.

Higher costs can take the form of higher prices for inputs or changes in the production that increase costs, such as higher taxes or more regulation. The two most significant input costs are the rate of interest and the price of real estate.

Most large economic investments are made with borrowed money. The interest rate in an economy determines the price of borrowing. When borrowing becomes more expensive due to a higher interest rate, investors stop allocating financial capital to projects with lesser rates of return. Therefore, there is less investment in the economy when interest rates are higher since a high interest rate makes weaker investments unprofitable.

As for the price of real estate, all economic activity requires physical space. Location is very important because the cost of bringing goods and services to market, the amount of demand in the local community, and the supply of labor for employers and raw materials for manufacturers are all determined by location. The more expensive land values are in general, the higher the cost of production and the lower the expected profits.

A peak in land values at the top of the real estate cycle always precedes the peak in the economy by a year or two. Both interest rates and real estate values are high and rising as the economy approaches the peak of the cycle. High costs of production choke investment and cause economic growth to slow. But why does the rate of growth turn negative thus causing the economy to contract?

The Financial Factor: Capital Goods & Interest Rates

Capital goods are the tools of production: machines, buildings, and inventory. They are physical things waiting to be consumed by the process of economic production. Money and bonds are mere financial capital not capital goods.

Not all capital goods are the same. The Austrian school teaches capital goods have a time structure that differentiates those goods that are quickly consumed in production from those that take decades to develop and use up.

Foldvary uses the analogy of a stack of pancakes to explain. The pancake on the bottom of the stack represents household goods, like food, that are quickly consumed. The second level in the stack represents circulating capital, specifically those goods that have a high turnover, like the eggs on a store shelf that are readily made into food. The next level up represents goods that take several weeks or months to sell, such as baby chicks that will grow into chickens. The next level represents capital goods that take a few years to mature into a consumable product, like the trees that will produce the wood to build a chicken coup. The level at the top of the stack represents capital goods like new housing developments that take a decade or longer to plan, build, sell, and eventually use.

We can readily see the production of higher-order goods involves a lengthening of the “period of production,” which is the duration of time between making an investment and reaping the profit. One can eat food any time one chooses; one can prepare eggs to eat in a few minutes; but it takes longer to raise a chicken to produce the eggs; longer still to grow the tree that will provide the wood to house the chickens; and longest of all to build one’s own house to live in while you’re tending to your chicken farm. In this way, higher-order capital goods produce lower-order capital goods, which in turn produce consumer goods that are ready to be used.

In a free market, a natural rate of interest will arise that determines whether to allocate resources to the production of higher or lower-order capital goods or consumer goods. The interest rate will equalize savings and investments of various kinds, balancing the amount of consumption and investment in the economy so that there is no over- or underproduction. If people save more and consume less, then reduced consumption will be offset by greater investment, since a greater pool of savings to fund investments reduces interest rates. Conversely, if people save less and consume more, interest rates rise as the supply of savings to invest shrinks.

But almost all economies in the world do not have a free market in the money supply. The Fed manipulates interest rates using the fractional reserve banking system and fiat money. When the Fed wants to lower interest rates and stimulate investment, it starts buying US treasury bonds using money it creates out of thin air. As more money is introduced into circulation in the economy, bank reserves increase, which facilitates more lending for investment, which reduces interest rates.

When a central bank artificially lowers interest rates away from the natural interest rate, capital formation begins to differ from what would occur under a free market. Lower interest rates cause more investment in higher-order goods, like housing, which investment would otherwise not be warranted by free-market demand. Investors make allocations to higher-order goods they otherwise would not have made if interest rates were at their higher, natural level. Even bad investments become profitable because the money one borrows to make them is cheap if not free.

Inflating the money supply inevitably forces the Fed’s hand to raise interest rates to combat rising prices. Higher interest rates do not affect lower-order capital goods or consumer goods. The shorter time structure of these goods mean investments in them are quickly recouped. You get back the money you spend on eggs in a matter of days by eating them.

But higher-order capital goods that take a long time produce, sell, and bring into economic use are very sensitive to interest rates. The money invested in goods like housing is tied up for years before an investor sees any return.

When interest rates start rising, weaker investments in real estate turn bad. Projects with expected returns on investment less than the interest rate are suddenly underwater. Investment in housing falls. House prices fall. Banks stop handing out cheap credit. Construction of houses slows down. Builders lose their jobs. Aggregate demand decreases for secondary goods like furniture and services like plumbing. Less goods and services are supplied. The economy begins to contract.

Manipulating interest rates and the money supply to create monetary stimulus is like an athlete using steroids: performance will increase in the short-term, but it comes at the cost of damaging oneself in the long-run. The ultimate result is economic waste as consumer goods and lowered-order capital goods are used up in the production of unprofitable high-order capital goods. Some projects are left uncompleted and do not even begin to repay investors since they never go on to produce anything at all.

The Real Estate Factor

Land values increase in the long run for several reasons. First, land is of fixed supply but subject to rising demand as population increases and technology advances. Second, public spending on local public goods like hospitals, schools, roads, etc., gets capitalized as higher land values. Third, governments give tax breaks to land in the form of deductions for mortgages, exemptions from capital gains taxes for primary residences, and caps on the rate of property tax, e.g., California’s Proposition 13.

Fourth, speculation land values will continue to increase causes prices to rise even faster. During the expansive phase of the cycle, investors anticipate further increases in land value, which induces speculators to buy land for price appreciation rather than to use the land. Real estate values rise above the level warranted by present use.

Ever-accelerating increases in land value is not sustainable in any economy. Once speculation becomes widespread, excessive land values increase costs for business. The high cost of access to land locks labor and capital out of the market. Expectations of profits are reduced if not eliminated. Investment slows. Aggregate demand suffers. Unemployment rises.

Banks toughen lending rules when property prices stop rising. Demand for land falls further making land more difficult to sell. Real estate prices come under pressure. Uncertainty in the real estate market causes a credit crunch affecting not only homeowners but also asset-backed commercial paper.

The reduction in the supply of loanable funds raises interest rates at the same time the Fed is reducing the money supply to mitigate inflation. Some homeowners with adjustable mortgages go into default as rates rise and property values fall. More properties get dumped on the market, causing prices to fall further.

As expected revenues from housing fall, even less investment is made into higher-order capital goods like construction. The construction industry acts as a transmission mechanism to spread the slowdown from the real estate market into the broader economy. Demand for other durable goods like furniture, appliances, and office equipment falls as construction slows.

The recession spreads into different sectors. People lose their jobs. Businesses and banks fail. Real estate prices collapse. A long depression ensues because extreme overbuilding during the speculative boom cannot be corrected quickly. Eventually land values revert to the long-term ratio of land price to rental value.

Synthesizing The Real & Financial Factors

Foldvary summarizes the geo-Austrian synthesis of the real and financial factors.

At the beginning of the expansion, the banking system expands credit by an amount greater than is warranted by available savings. This artificially reduces interest rates; the skewed market rate is lower the normal natural rate. Low interest rates induce investment in higher-order capital goods, much of it consisting in real estate construction, related infrastructure, and durable goods.

As the expansion turns into a boom, land speculation sets in, fueled still cheap credit. Land rent and prices then rise higher than is warranted by current use. Meanwhile since consumer time preference has not changed, the demand for consumer goods continues as before, and prices rise. When the money expansion providing cheap credit ceases and inflationary expectations affect the market for loanable funds, interest rates rise, especially affecting the interest-sensitive real-estate market. Higher costs (which can include higher taxes and labor costs along with higher interest rates and more expensive land) now reduce the rate of increase new investment. The higher-order investments, chief among them real estate, turn out to be malinvested, as there is insufficient demand for the capacity, with vacancies in shopping centers, hotels, office buildings, apartments.

The negative second derivative (decrease in the rate of growth) eventually slows the expansion and brings on the decline, which accelerates as the reduction in demand follows the cessation of investment due to costs. This scenario is consistent with the empirical data showing real-estate construction as well as prices peaking before the onset of the depression. Once the recession begins, then as real-estate prices fall, loans start to exceed the value of the properties. The real-estate collapse brings many banks down with it, and it may take some time for banks to recover.

The depression of real-estate as well as the decline in other prices now makes investment more attractive. The cycle then moves again to the expansion phase. Note that even if credit is not unduly expanded, real estate speculation could still cause the cycle, but it is considerably dampened if interest rates are not artificially depressed.

The Coming Depression

The key question is when will the peaks in the real estate and stock market occur.

As discussed above, shocks to supply or demand, fiscal policy, and monetary policy can affect the timing of the real-estate cycle. Any forecast of when the peak in markets will occur inherently includes a moderate amount of uncertainty.

That being said, we know the last peak in house prices before the Great Recession occurred in mid-2006. Presuming the 18-year average holds true, the next peak in house prices will occur in mid-2024 with the stock market peaking about a year later in mid-2025. The crash in land values and the stock market is therefore most likely to occur in 2026. This timeline aligns with Fred Foldvary’s 2012 prediction the next depression would occur in 2026.

They will say there is no way to accurately predict such an event so far in advance. But the cycle exists precisely because people don’t believe it.

[. . .]

By 2014, population growth and demolitions will have reduced the vacancies from the construction bubble, and then the growing economy will pull up rents and land values, attracting the speculation that will generate a ten-year real estate bubble that will peak around 2024.

Shocks from outside the US economy could alter the cycle timing. [ ] If such shocks don’t interrupt the cycle, the deep fiscal and monetary structures of the US economy, which have not changed in 200 years, will generate the next boom and bust just as they have done so in the past. But the Crash of 2026 will be much worse than that of 2008, because as the US government continues its annual trillion dollar deficits, by 2024, the US debt will have grown so large that US bonds will no longer be considered safe, and in the financial crisis, the US will no longer be able to borrow the funds needed to bail out the financial firms.

[. . .]

We are now far upstream, but heading down into the river of no return to the real estate and financial waterfall of 2024-2026.4

(Emphasis added.)

Fred Harrison’s prediction has not changed since 2005. In 2021, Harrison reaffirmed in his most recent book We Are Rent: Capitalism, Cannibalism and why we must outlaw Free Riding his view real estate values will peak and crash in 2026. Investors and homeowners should therefore be alert to the likelihood of a major reversal in valuations sometime between 2024 and 2026.

My personal view is the peak and crash will come sooner rather than later due to the central banks’ response to the shock of the COVID-19 pandemic. Central banks, especially the Fed, went into a money-printing frenzy to try to prop up the stock market and broader economy. The result is certain to be high levels of inflation, which I doubt will be “transitory.”

The risk of a policy mistake has increased because the Fed may already be behind the curve on inflation. The Fed may need to raise interest rates multiple times in rapid succession to keep prices from running through the roof. There is an increasing possibility we end up in a situation similar to 1980 when the Fed allowed run-away inflation to hit almost 15 percent and responded by raising interest rates to almost 17 percent.

As a result, I am not going forecast when the peak in real estate will occur. I am going to teach you how to use readily available data to determine the peak in real estate values. Once the peak in real estate is in, you can follow the stock market over the 12 to 24 months thereafter looking for opportunities to short various assets.

The waterfall is looming: you better start swimming for the riverbank now while you still have a chance to make it . . . .

The Current Macroeconomic Climate

Think of the current macroeconomic climate as a mosaic of different data points. You will not be able to see the bigger picture by looking at just one or two pieces of data. You need to look at a number of data points to get the whole picture.

You can find free data on all of the following points online using your favored search engine. The key pieces of data you should follow are:

Rental vacancy rates.

GDP growth rate.

M1 money supply.

Inflation rate.

Stock market valuations.

Business investment.

Corporate profits.

The Fed target interest rate.

Housing starts.

New building permits.

Orders of durable goods.

New home sales.

Existing home sales.

Existing homes inventory.

U.S. home prices.

California home prices.

Nonresidential construction investment.

The first data point to consider is rental vacancy rates.

As long as the current occupancy rate exceeds the long-term average, there will be upward pressure on rents. As long as there is upward pressure on rents, new construction is financially feasible. This is the case for both the expansion and hypersupply phases.

The delineation point between expansion and market hypersupply is marked by a peak in occupancy rates. The transition from hypersupply to recession is marked by occupancy rates falling below the long-term average.

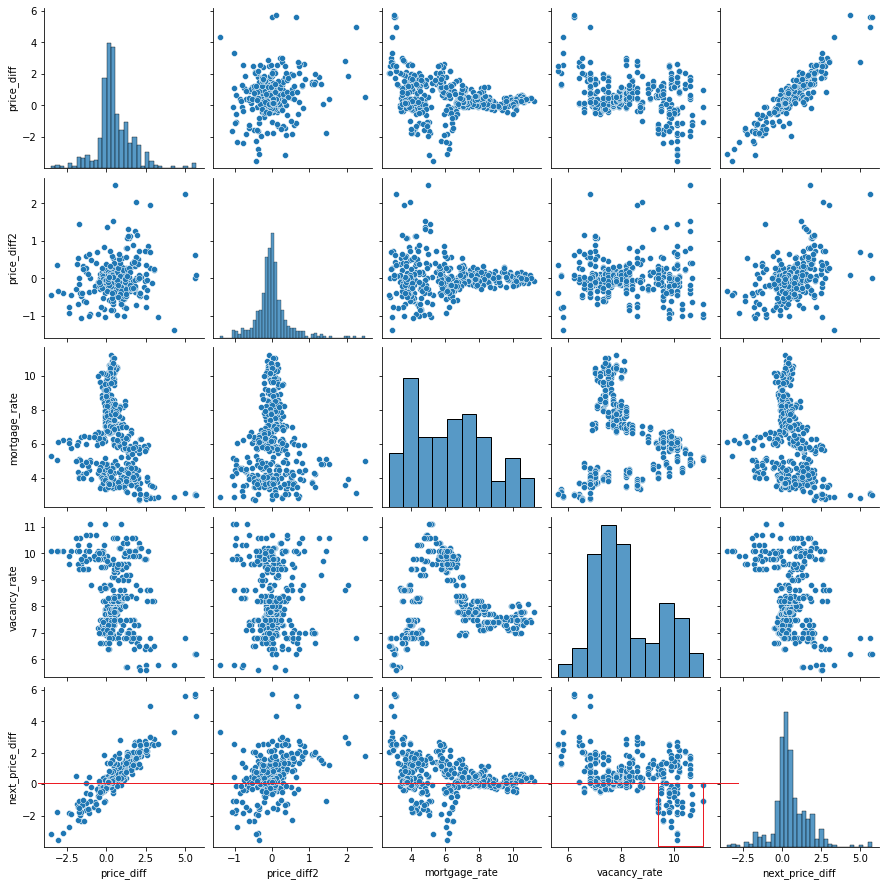

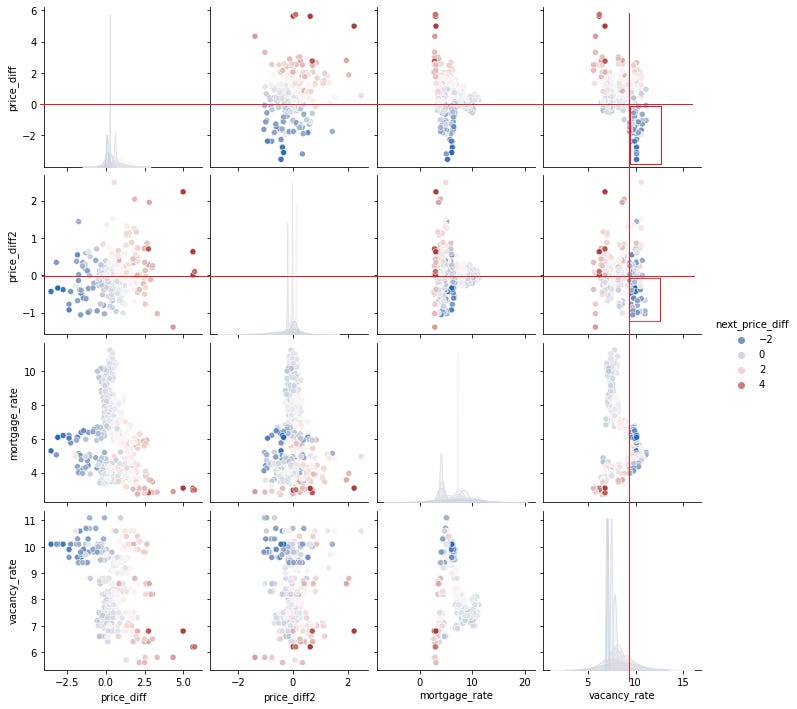

Thanks to /r/georgism’s very own /u/xoomorg we can identify the level at which occupancy rates indicate a heightened risk to home prices. Using the Fed’s data on vacancy rates across the U.S. economy and U.S. home prices, and data from Freddie Mac on mortgage points and rates, /u/xoomorg created a matrix showing the univariate distributions for each variable on a month-to-month basis.

/u/xoomorg’s first analysis suggests decreases in U.S. home prices during the Great Recession occurred when occupancy rates fell below 90.5 percent (equivalent to a 9.5 percent vacancy rate or greater).

/u/xoomorg then conducted a second analysis using ordinary least squares linear regression. This analysis focuses on two derivatives: the first derivative is monthly changes in home prices (“price_diff”) and the second derivative is the rate of change in home prices from month-to-month (“price_diff2”). (The formula for the model is next_price_diff ~ price_diff * price_diff2 * mortgage_rate + vacancy_rate.)

The linear regression gives a similar picture when actual future price changes are included in the model.

Homeowners and investors should therefore watch Fed data on vacancy rates as a leading indicator of real estate values. Home prices peaked three years after vacancy rates exceeded 9.5 percent.

However, since the analysis is based largely on the Great Recession and past performance is no guarantee of future outcomes, it would be best to supplement this analysis with occupancy data from your city or state.

The chart below shows the growth rate in the US economy as measured by GDP from 1996 through the end of 2021. The recession is on when the quarterly GDP growth rate slows and starts trending towards zero.

Q2 2020 saw a 31.2 percent reduction in annual GDP in face of the COVID-19 pandemic, which was immediately followed by a 33.8 percent increase in GDP in Q3 2020. The downturn in output following the outbreak of the pandemic was much, much more severe than in 2006-2008.

But what drove such an explosive increase in economic output in but the very next quarter?

The Fed went absolutely berserk in response to COVID-19 to prop up the stock market, real estate values, and the economy as a whole. The pandemic response resulted in an expansion of the M1 money supply from $4 trillion dollars to more than $20 trillion dollars in the space of only two years.

What is the consequence of printing money willy-nilly?

The dollar is worth 7.5 percent less than it was just one year ago. Inflation is now at the highest rate since the 1974 stock market crash, which resulted in Paul Volcker continuously hiking interest rates until the Fed brought “both the economy and inflation to a standstill” in 1981.

It is worth noting the Fed began printing money like there was no tomorrow at the beginning of Q2 2020. However, increases to the money supply did not pass through as inflation until 2021. Moreover, the CPI data lags inflation rates in real assets, according to Foldvary.

The Fed is not letting the [free market] interest rate do its job of adjusting consumption and investment. The boosted new investment competes with consumption in the market, and so prices rise. The new money creates price inflation, but prices don’t all rise at the same rate. Prices rise faster where the new money is being loaned out, such as for purchasing and constructing real estate.

We may not see much increase at first in the consumer price index, and it seems like “inflation is under control,” but in actuality, there is high asset price inflation, rising real estate prices and a rising stock market.

Speaking of the stock market, how is the S&P 500 doing?

When adjusted for inflation, real returns on the S&P 500 showed a 6.89 percent real return in the past year. (Average real returns since Oct 2007 at the peak of the last stock market through Feb 2022 come to 5.18 percent per year.)

Although a 6.89 percent real return seems like a good investment, bear in mind this means rational agents will direct their resources towards financial investment in stock indices unless they have an economic investment opportunity that will return 7 percent per year. And this is while interest rates are at historic lows. When interest rates rise, there will be even less economic investment, especially in high-order capital goods. Ultimately, less economic investment will result in the value of stocks falling.

Nonetheless, for the time being, corporate profits and investment remain at healthy levels.

Until corporate profits and investment begin to retract, we can expect the stock market valuations to remain high.

A leading indicator of a downturn in the stock market is the yield curve inverting on U.S. bonds. The interest rate on debt with a longer duration offers a higher rate than debt with a shorter duration in normal circumstanes. The higher rate is to offset the greater risk of longer duration loans in an uncertain future.

However, sometimes the rate on shorter term debt exceeds the rate on longer term debt because investors expect risks in the near future that exceed risks in the long run. This is when the yield curve “inverts” with shorter duration debt carrying a higher interest rate than longer term debt.

Currently the “spread” or difference between 2-year and 10-year government bonds is narrowing and trending towards zero. If the trend continues at the same pace, the yield curve on the 2/10-year bonds will invert this summer.

Historically, recessions have occurred between six to 18 months after an inversion in the 2/10-year curve. On average, recession occurs 15 months after an inversion, according to Bank of America. The only false positive, where an inversion in the 2/10-year was not followed by a recession shortly thereafter, was in 1965.

Investors should also watch for inversions in the 3-month and 30-year spread. After an inversion, stocks tend to decline shortl and sharply after the 3m/30y yield curve reverts.

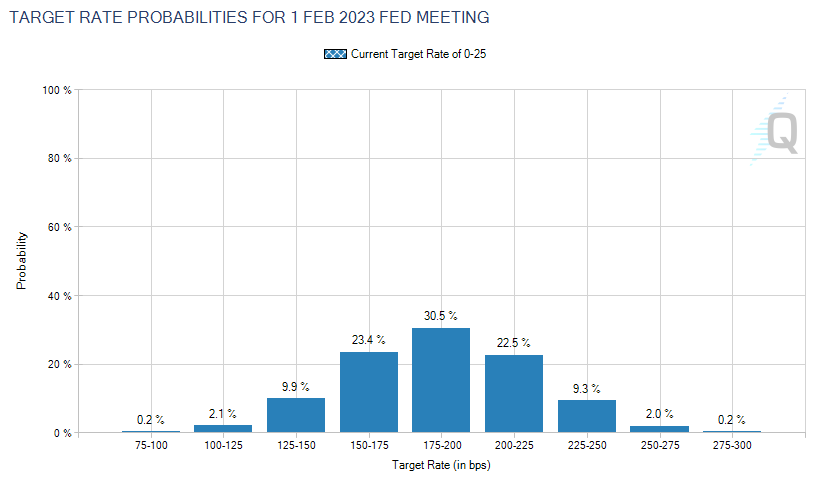

It is hard to avoid the conclusion it is late in the business cycle to be buying stocks as the spread in the 2y/10y tighten. This is especially true considering interest rates are expected to rise to 1.75 to 2 percent by Feb 1, 2023.

However, when rates rise, bond prices fall, so stocks become the more attractive investment. But that is in relative terms: stocks will also fall along with bonds in the face fo rising rates.

Moreover, considering there is generally less opportunity to make economic investments due to the pandemic and rising rates, one might wonder whether equities are crowded but not yet too crowded. People are definitely trying to beat inflation by piling into stocks. And now is definitely not the best time to be buying stocks just as rates are rising. But buying stocks now may be the only way to avoid getting punished by inflation.

The trick will be balancing a 7.48 percent annual inflation rate (amounting to 33.4 percent over the next four years), which punishes holding cash instead of investing, against the expected melt-up in stock valuations over the next two to four years as the market tops out, against a 60 percent plus downside in equities from peak to trough within the next two to four years.

Although economic growth as measured by GDP and the stock market indicate we still have a few years to run before the anticipated peak, it is impossible to ignore the fact these gains were driven largely by the Fed’s unprecedented money-pumping scheme, so interest rates will have to rise soon and quickly. Higher interest rates will eventually choke off investment in higher-order capital goods, sowing the seeds of the crash.

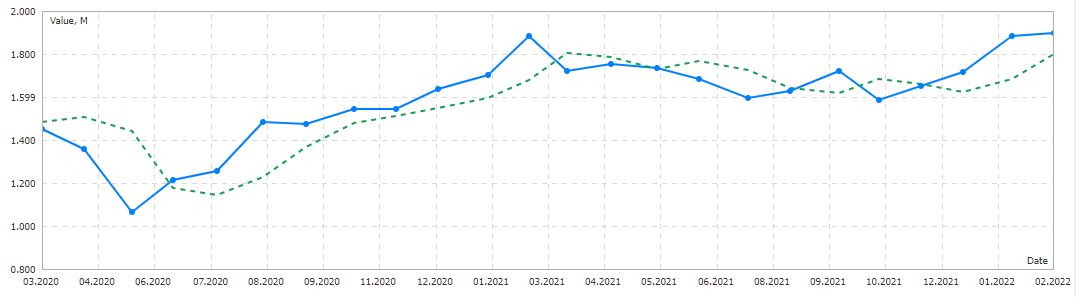

For the time being though, U.S. housing starts are above the trendline of support since 2019 after recovering from the shock of the pandemic.

However, new housing projects are around the same level now as they were just before the pandemic hit. If the trendline of support is broken this year, it will be a key indicator that higher inflation and interest rates have resulted in a reduction in investment in higher-order capital goods: the hallmark of an impending recession.

New building permits have also recovered since the pandemic and are at a high, above expectations.

Housing projects take a long time to plan. Plans, once made, are not easily abandoned, especially when millions of dollars are burning a hole in an investor’s pocket. Developers may be making one last push to start their constructions before interest rates go up.

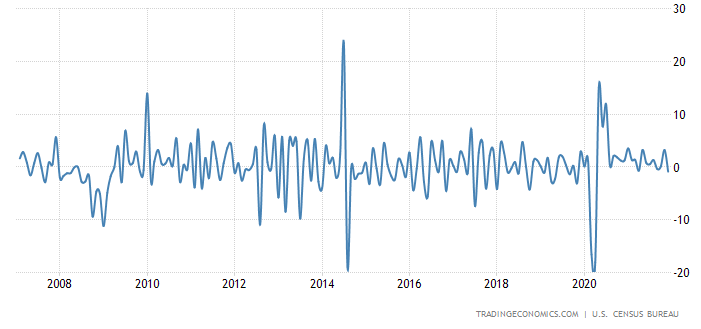

Month-on-month orders for durable goods have turned negative, however.

Although the data is still within a normal range of variance, it is clear that the money-printing boost from the Fed in 2020 did not result in sustained orders.

Turning to residential real estate, new and existing home sales in the U.S. underwent a steep increase as people moved out of major cities in response to the pandemic.

Since the Fed started printing money in response to the pandemic, there has been a sharp drop in sales of new homes as inflation in input costs has dampened demand for new constructions. Buyers appear to be more focused on existing homes, which sales figures are elevated but still beneath the peak in Q2 2006. Institutional buyers like BlackRock have been purchasing existing homes “like there is no tomorrow.”

The consequent reduction in inventory has limited choice for first-time buyers just as rising land value prices put most homes out of reach for the average individual.

Average home sales price in the U.S. hit $280,000 while the average sales price for a house in California breached $800,000 in Q1 2022. Prices will continue to increase until peaking around 2024-2026.

The good news for first-time homebuyers is California home prices fell from an average of almost $647,000 in Q3 2006 to less than $381,000 in Q1 2012, which represents more than a 40 percent loss during a recession. The depression in real estate prices lasted for more than five and a half years. Such a long window of opportunity is a rare chance for new homeowners. Well-prepared savers who do not need to borrow at higher interest rates to buy their first home will be the biggest winners.

Considering inflation in the money supply will make the next depression worse than the last, I think we can expect with a moderate-to-high degree of confidence average home prices in California will fall to $500,000 or lower in the next trough. There is a good chance the real price of a California home will be at or beneath the 2012 low after accounting for inflation.

Despite residential house prices being at an all-time high, the same cannot be said of construction spending in nonresidential real estate.

As noted by Foldvary, investment in nonresidential real estate is one of the highest-order capital goods that is hit hardest by rising interest rates. Unlike residential housing, commercial real estate has not gone on to make new highs since the Fed began the printing dollars post-pandemic.

In summary, the current macroeconomic climate suggests we are at the beginning of the last quarter of the 14-year expansionary phase. While GDP growth is healthy and business investment and corporate profits are healthy, the warning signs are readily apparent. Inflation is elevated; stock market valuations and house prices are inflated; interest rates will start rising soon; and investment in nonresidential construction has not recovered since the pandemic. The warning signs are not yet flashing red but investors should exercise heightened caution. Multiple indicators are showing a bubble in stock and real estate markets.

Begin thinking now about what changes you will make to your portfolio next year and how to prepare your personal finances for recession in 2024-2026.

Strategies for Recession

I am not a financial advisor and this is not financial advice. You are solely responsible for understanding your financial affairs and your risk. That being said, here are some observations to help you better understand the risks and plan accordingly.

Income & Savings

The most important thing you can do to prepare for recession is to maximize your income over the next two years. More income means more savings means less pain in a depression. Increase your rate of saving, if possible, by cutting out unnecessary expenses and luxury items now. Start growing your own food even if you live in an apartment.

Learning new skills and developing new streams of income should be your highest priority. My plan is to learn more about family (divorce) and bankruptcy law in the expectation those legal services will be more in demand than high-cost litigation and transactional work like contracts or estate-planning.

Employment

If you are considering a career change, check out the most recession-resistant jobs. IT and healthcare professionals and teachers are good jobs to have in a recession. Avoid jobs in manufacturing high-order capital goods and construction, if possible.

If you work for a large corporation, prepare to be laid-off. Build out your network in case you get the sack. Start looking for other options especially smaller, highly profitable companies to join. But remember: the last one in is the first one out in most companies. If you are thinking of changing employers for more pay or better job security, do so as soon as possible.

Think about what you would do to earn an income if you could not find an employer. It is not the best time to start your own business but how else would you work for yourself if you had no other options? At least your job security will be guaranteed if you work for yourself!

Going back to school is a great way to duck a recession and to develop higher earning potential in preparation for the recovery. Consider going to a lower-ranked school if that means more scholarship money or, even better, a free ride. Higher-skilled labor in professional services will always have an advantage in any economy over workers with more menial jobs.

Investment

Real Property

Falling land values in a recession and depressed real estate values do not affect homeowners who own their home outright and have no intention of moving. Homeowners who bought on credit are exposed, however, unless their income is guaranteed to be able to cover their mortgage payments.

Homeowners with mortgages and people who might want to sell their home and move should absolutely hedge their home equity by betting against the housing market in 2024-2026. A simple way of hedging your home equity is purchasing shares in an inverse REIT (real estate investment trust) like REK, SRS, or DRV. Inverse REITs gain value as homes lose value. More sophisticated investors might consider purchasing call options on inverse REITs instead of equity.

Gold & Silver

Gold and silver are classical hedges against inflation and financial crises. Although gold lost 35 percent in the 2008 financial crisis, which affected almost every asset class, it then went on a 180 percent tear from 2009 through mid-2011.

Premiums over the market spot rate to purchase physical silver are typically higher than gold. Owning physical gold is especially critical if there is a currency crisis. If the U.S. defaults on its debt, the world drops the dollar as the global reserve currency, and America suffers hyperinflation, the numbers in your bank and investment accounts and the dollars in your wallet will become worthless. Fiat currency and financial assets denominated in fiat ultimately rely on the illusion of value but gold is valuable in and of itself and always will be.

U.S. Dollar

The dollar performed well during the 2008 recession when cash was king. However, if Foldvary is right about global markets not considering U.S. debt safe in the next crash, this time around may be different, and the dollar could lose value vis-à-vis other major currencies like the euro.

Stocks and Bonds

In general, people sell stocks and buy bonds during a recession. However, as previously mentioned, U.S. government bonds may not be as safe as they seem. Bonds will lose value if the U.S. suffers a credit downgrade and crash hard if the U.S. defaults on its debt. My view is it is better to wait and see. I plan to buy bonds after the crash while interest rates are still high (and bond prices are low) once there is clarity on whether the U.S. will be able to service its debt or not.

As for equities, utilities, alcohol, and marijuana stocks are traditional defensive stocks. People like to get drunk and high during good times, but they like to get drunker and higher during bad times. And almost everyone needs to buy electricity. However, my top picks would be low-cost stores like Dollar Tree and Walmart, which see more business when people have lower real incomes.

Conclusion

The information above is to help you prepare for depression. I am taking a much more aggressive, risky approach with my own liquidity to maximize outcomes for a community land trust. My approach is not suitable for other people. I have a much higher tolerance for risk and adverse outcomes than most people. You should not attempt to copy these ideas unless you are are experienced in trading options and only then after doing our own due dilligence.

I recently inherited my father’s house in France. My plan is to liquidate the real assets by 2024, if not sooner, depending on analysis of the real estate cycle in France specifically.

I intend to hold about half of my cash reserves in euros, a quarter in yen, an eighth in sterling, and an eighth in dollars, although the exact allocation will depend on trends in currency markets. About half of my liquidity will be in cash and the other half will be allocated to short positions in dollar-denominated assets.

At the time of writing, I intend to short mainly ETFs rather than individual stocks. Most retail investors own ETFs of indices to diversify their holdings through one position. The disadvantage of the ETF as an investment vehicle is it is subject to large decreases in value during liquidity crises. When everyone wants to sell and there are only a few buyers, it’s easier to sell individual stocks than it is to sell a basket representing the entire market or market segment.

Specifically, I am looking to short ETFs representing the major indices like SPY and QQQ; corporates like LQD, HYG, and JNK; and real estate and builders like VNQ, IYR, and ITB. (Conversely, I would look to buy calls on the inverse REITs like REK, SRS, and DRV.) I am also thinking of shorting ETFs of U.S. government debt like IEF and TLT. Because most people think U.S. debt is “safe,” and I have the opposite view, prices to bet against treasuries will likely be very attractive. This is the “big short” v2.0 similar to the Brownfield fund shorting AA-rated mortgage back securities in 2008. Speaking of which, a simple way to discover over-valued stocks is to keep an eye Dr. Michael Burry’s Scion Asset Management’s quarterly 13f filings with the Security and Exchange Commission.

I prefer options to shorting equity although you should not trade options until you understand the Greeks. (Stay very, very far away from options if you do not know what that means!) Specifically, I prefer LEAPs (long-term options) with time-to-expiry between 12 and 24 months. LEAPs have higher implied volatility in general than options with a shorter term to expiry, so it is very important to buy LEAPs when IV in the underlying is low.

To that end, my plan is to start buying 2-year puts on real estate ETFs once real estate prices have been off their highs for six months and puts on stock indices three months later. At that point, about nine months after the top in real estate prices, real estate ETFs should be falling, and the top of the stock market should be about three months away. Once the stock market begins to show weakness and IV is increasing, I will add to my positions with 1-year puts on stocks and 6-month calls on inverse REITs (since longer dated options are not available on inverse REITs).

I will start exiting positions in tranches when losses in the stock market pass 50 percent from the all-time high. At that point, bonds will probably be up as people will have moved investment into “safer” assets. I will leave most profits in cash and reinvest some profits in 6-month puts on bond ETFs. I will also keep an eye on the crypto markets for long-term acquisitions but am hesitant to actively trade crypto because there is no established track record of how the asset class performs in a broader market crash.

And that, ladies and gentleman, is how I plan to fund the acquisition of acreage in northern California and/or Washington state to seed a community land trust.

This is Law and Politics. Until next time . . . .

Foldvary, Fred E., The Depression of 2008 (Sept. 18, 2007). Available at SSRN: https://ssrn.com/abstract=1103584 or http://dx.doi.org/10.2139/ssrn.1103584/

Foldvary, Fred E. “The Business Cycle: A Georgist-Austrian Synthesis.” The American Journal of Economics and Sociology, vol. 56, no. 4, [American Journal of Economics and Sociology, Inc., Wiley], 1997, pp. 521–41, http://www.jstor.org/stable/3487330.

The Depression of 2008, p. 4.

The Depression of 2008, p. 12.